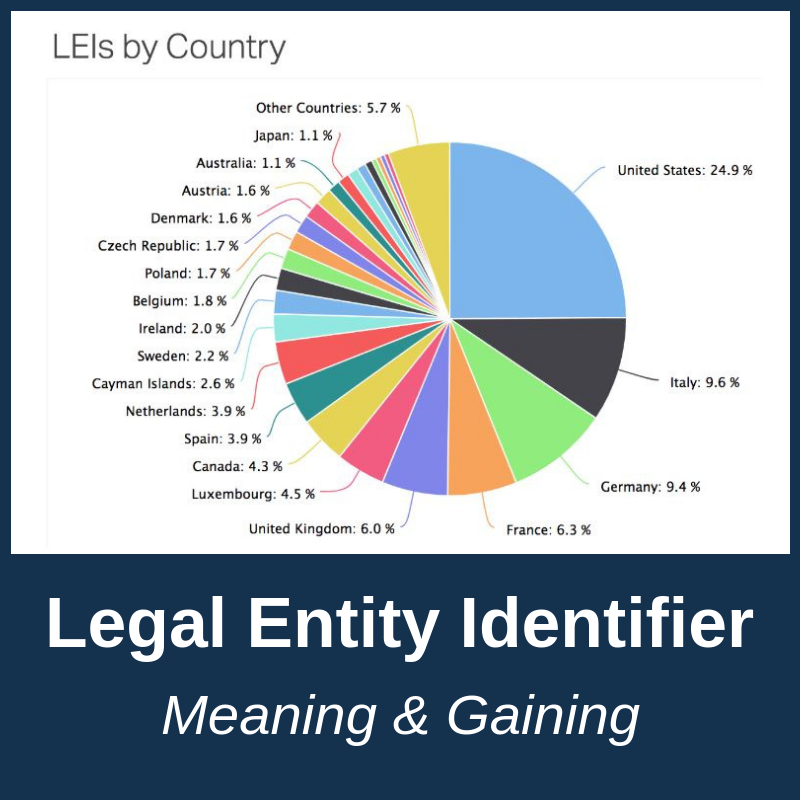

The global push for greater transparency in financial markets continues to gain traction with top tier regulators now requiring that all entities, engaged in trading financial markets, report their LEI (Legal Entity Identifier) number to regulatory repositories.

In the European Union, this process started as of January 3rd, 2018 as per MIFID 2. In Australia, in accordance with ASIC Corporations (Derivative Transaction Reporting Exemption) Instrument 2015/844, relief from the requirement to report the entity Identifiers ends on September 30, 2018, which means that starting from September 30, 2018, entities regulated in Australia will need to report LEI numbers for their corporate clients.

If you don’t currently have an LEI issuer (LOU) in your country, you can use any authorized LEI-code issuer offering cross-border services.

If you don’t currently have an LEI issuer (LOU) in your country, you can use any authorized LEI-code issuer offering cross-border services.

Some of these registries serve one specific country, while others offer their services to entities worldwide, but please be mindful of the fact that there may be significant differences in the languages available, the ability to register many entities in bulk, and price, amongst other things. You can check the websites of these registries to find the one that best suits your needs.

LEI codes are international registration codes and not country specific. A full list of code-issuers can be found here.

How to get an LEI number

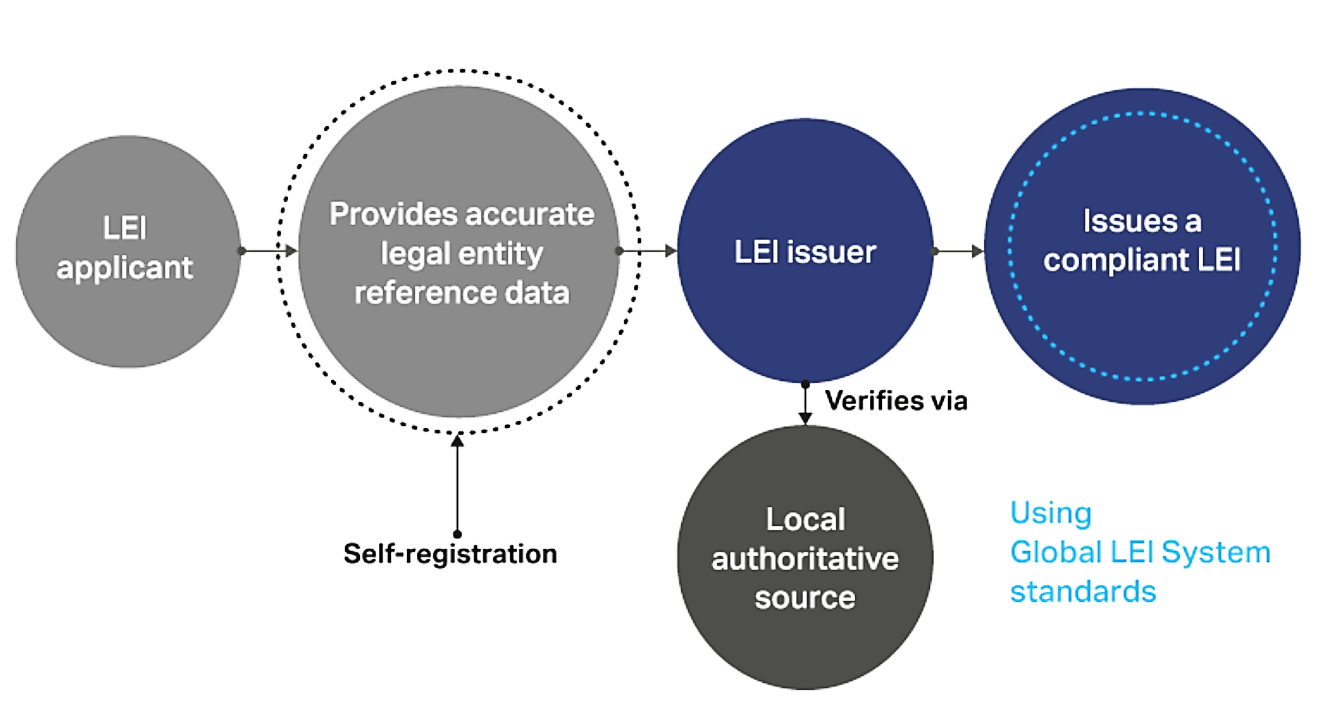

To get an LEI number, you should expect to go through the following simple process:

- Self-registration: Only an entity eligible to receive an LEI or its authorized representative may obtain a LEI code. The permission of the LEI registrant to perform an LEI registration on its behalf by a third party is considered to satisfy the requirements of self-registration only if the registrant has provided explicit permission for such a registration to be performed.

- The LOU will collect a minimum set of reference data on the entity (e.g. name of the entity and address).

- This reference data has to be confirmed or certified by the entity seeking an LEI. Entities are requested to periodically verify the continued accuracy of their reference data (e.g., at least through yearly certification)

- The LOU is required to check each entry against reliable sources (public official sources such as a business registry, private legal documents) prior to publishing the LEI and associated reference data. This explains a delay between the request for an LEI and the publication of the LEI.

LOUs generally charge a fee for issuing the LEI as well as for validating the reference data upon issuance and after each yearly certification.

We have looked at all the LOUs available and have summarized the three LOUs (Local Operating Units) that, in our opinion, support the widest range of international jurisdictions. (Obviously, the decision on which service to choose is one that each company needs to make on their own after weighing up all the factors):

| LSE (London Stock Exchange) | GMEI Utility | Bloomberg LP | |

| Registration Link | → Link | → Link | → Link |

| 1. User Guide | Download a free Complete LOU Comparison Summary with Fees |

||

| 2. Cost | |||

| 3. Required Supporting Document | |||

| 4. List of Jurisdictions Supported | |||