advanced ONBOARDING

Trading Guidance

Advanced Markets offers essential insights on margin, position sizing and trading costs, helping traders navigate margin calls, swaps and fees.

These Guidelines are subject to change based on volatility and changing market conditions

CHANGE CONTROL

All requested changes to the Advanced Markets (UK) Limited setup must be communicated via email to our staff for review and approval before going live. In the absence of such communication, our standard service guidelines will remain in effect.

Additional Disclaimers

The FIX API setup and configurations are deployed “AS IS” by mutual agreement. No guarantees—express or implied—are provided regarding errors, data loss or malfunctions arising from third-party services.

Indemnification:

The client agrees to hold Advanced Markets (UK) Limited, its officers, employees, agents and assigns harmless from any claims, liabilities, losses, damages, costs or expenses arising from:

Use of their own trading system

Any claims resulting from third-party relationships

Acts or omissions in service performance as outlined in this Statement of Work

The client is solely responsible for their technology setup and regulatory compliance.

Margin Call Procedure

Advanced Markets (UK) Limited will issue email notifications to clients regarding margin usage. Alerts will be triggered at the following levels:

70% Used Margin/Equity: Initial alert sent to the client’s emergency contacts

90% Used Margin/Equity: A follow-up alert is sent to the same contacts

100% (Liquidation Level): All open positions in the client’s Fortex account will be liquidated. This update, including balance and equity changes, will be visible in the Fortex Online Backoffice and sent via email to emergency contacts

Margin Call / Liquidation Alert Email Notifications

Email alerts for margin calls or liquidation are offered as a courtesy. While provided as an added service, these alerts are not guaranteed and should not be relied upon as the sole method of managing margin. It remains the client’s responsibility to monitor their account and maintain sufficient margin at all times.

Clients may add email addresses to receive alerts and daily trading statements by accessing their respective back office platform (e.g. Fortex or PrimeXM).

For Fortex users:

Log in to https://amuk.fortex.com

Navigate to:Account → Personal Info → Edit

Input desired email addresses (use semicolons “;” to separate multiple addresses).

For PrimeXM users:

Please follow the standard email configuration steps within the PrimeXM portal. For assistance, contact your account manager or support team.

Important:

Advanced Markets is not liable for delays, technical issues or other problems affecting email delivery. Volatile market conditions may result in margin calls or liquidation without prior notice. Clients are fully responsible for monitoring and managing their positions at all times.

Margin Guidelines

The following guidelines apply to all accounts:

General Margin Guidelines

Applies to FX Pairs / Overall Account Total: Metals & CFDs

100:1 for accounts less than $50 million

50:1 for accounts less than $20 million

50:1 for accounts between $50 to $100 million

25:1 for accounts between $20 to $50 million

25:1 for accounts between $100 to $200 million

10:1 for accounts over $50 million

10:1 for accounts over $200 million

Note: Custom conditions may apply. All values are in US Dollars. When multiple instrument types are combined (e.g. FX majors, non-majors, CFDs or Metals), the “Overall Position” limits apply.

Weekend-Specific Guidelines

Before each weekend, account equity must be at least double the margin required to maintain open trades. This means the Margin Ratio (as seen in the account window) must be below 50% by the close of trading on Friday.

Failure to meet these guidelines may result in position reductions, as instructed by Advanced Markets trade support.

Calculation of Overall Position and Margin Requirements

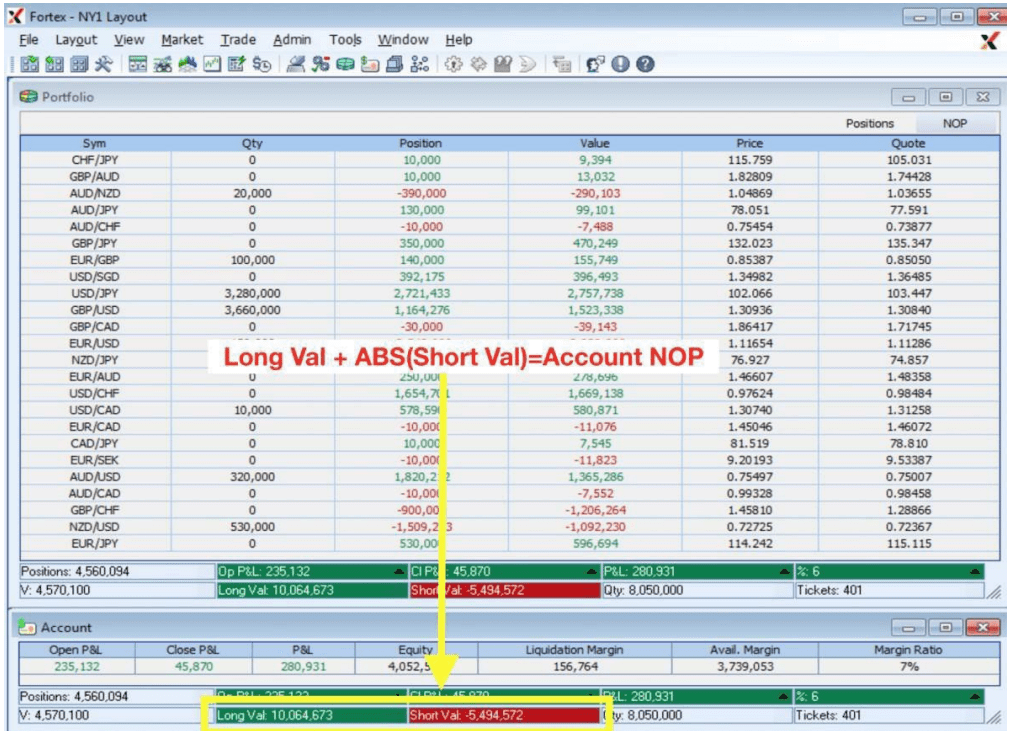

To determine an account’s total open position, Advanced Markets sums the absolute values of all long and short positions, as seen in the Portfolio window.

Example:

Total open position = $15,559,245

-> Long Value: $10,064,673

-> Short Value: $5,494,572

This analysis helps determine whether margin requirements are being met across both the Portfolio and Account windows.

(This represents the sum of the “absolute” values of each symbol’s open position in the portfolio window.)

Weekend Compliance

To comply with Advanced Markets’ margin guidelines over the weekend, your account equity must exceed twice the value of your liquidation margin.

Example:

If your liquidation margin is $156,764, then your equity must be greater than $313,528 before market close on Friday.

Weekend Compliance

To comply with Advanced Markets’ margin guidelines over the weekend, your account equity must exceed twice the value of your liquidation margin.

Example:

If your liquidation margin is $156,764, then your equity must be greater than $313,528 before market close on Friday.

Swaps in Fortex 5 Platform / Advanced Markets Omnibus Account

Swap rates—also known as the cost of carry—reflect the interest rate differential between currencies in a pair and are embedded in currency trades. While primarily influenced by these differentials, swap rates also account for:

Deviations in interest rates

Swap period/tenor

Exchange rate fluctuations

Market volatility

Liquidity

Each currency pair is tied to a spot value date (T+1 or T+2). At 5:00pm ET daily, the value date rolls forward (excluding holidays). Rolling over a position may result in a credit or debit depending on the carry:

Being long the higher-yielding currency typically results in a credit

Being short may result in a debit

Additional Notes:

Swap rates are based on Tier-1 bank pricing

Trades open after 5:00pm ET incur swap charges at that time

Weekend Swap Tripling:

T+2 currencies: Tripled on Wednesday at 5:00pm ET

T+1 currencies: Tripled on Thursday

Adjustments are made for holidays as required

Where to View Swap Rates:

Swap rates can be found in the Fortex Back Office under Settlement Reports. Click “Swap Rates” to view USD-based rates (based on a 10K position).

CFDs on Indices: Daily Dividend Information

For accounts enabled for CFD trading, daily dividend info is available in the Fortex Back Office: https://amuk.fortex.com

Steps:

Log in

Navigate to the “Schedule” tab

Select “Corporate Actions”

View dividend details on the “Corporate Action – Dividend” page

CFDs Monthly Fee & Other Fees

- A monthly market data fee begins once account login credentials are issued

- If credentials are issued by the 15th, the full monthly fee is charged

- If issued on or after the 15th, the fee applies starting the next month

Minimum Monthly Fee

Case A:

If your monthly trading volume is below the minimum stated in the Fee Table, you will be charged the difference between your trading fees and the minimum monthly fee.

This charge is processed during the first 10 business days of the following month.

Example:

If the minimum invoice is $2,000 and you’ve paid $1,500 in trading fees:

$2,000 (minimum monthly invoice) – $1,500 (trading fees) = $500 charge

Case B:

If your volume exceeds the minimum, no extra charge applies.

Additional Resources for Review

List of Instruments Available for Trading

Trading Instruments and Liquidity Details

Contact Information for Various Departments

Stay Informed with the Latest

Market Updates

Get in TOUCH

Office Location

1, Unit 5, The Warehouse, Woolyard, 52-56 Bermondsey Street, London SE1 3UD

Phone Number

+44 204 591 4168