A Payment Processor is a company that acts as a kind of mediator between the bank and the merchant, in a transaction. The payment ecosystem is complex with different terms and processes to get used to. Today I’m going to discuss various terms used in the online payments and a simple guide to the entire payment process.

Key participants in online payments:

Merchants – Business that provide goods /services.

Payment Processor – (Payment service provider, acquirer) manages the transaction process, acting as a kind of mediator between the bank and the merchant (Eg: Paypal,skrill).

Acquirer – Merchant banks, Sometimes the payment processor and the acquirer are one and the same.

Issuer– The issuer, or issuing bank, is the cardholder’s bank, which is responsible for paying the acquirer for approved card transactions.

PCI compliance – PCI compliance refers to compliance with the PCI DSS, the Payment Card Industry Data Security Standard. PCI DSS is an information security standard that applies to all entities involved in processing, storing, and/or transmitting payment card information. Any merchant that accepts card payments must comply with PCI mandates. Failure to achieve and maintain PCI compliance can leave a merchant vulnerable to a data breach and the ensuing negative fallout including fines, fees, and lost business.

Payment Gateways are like middlemen between the third-party payment processor/merchant account and the credit card companies. It’s a type of software that handles the technical side of transferring cardholder information.

Merchant Account is a type of bank account that accepts credit and debit card payments.

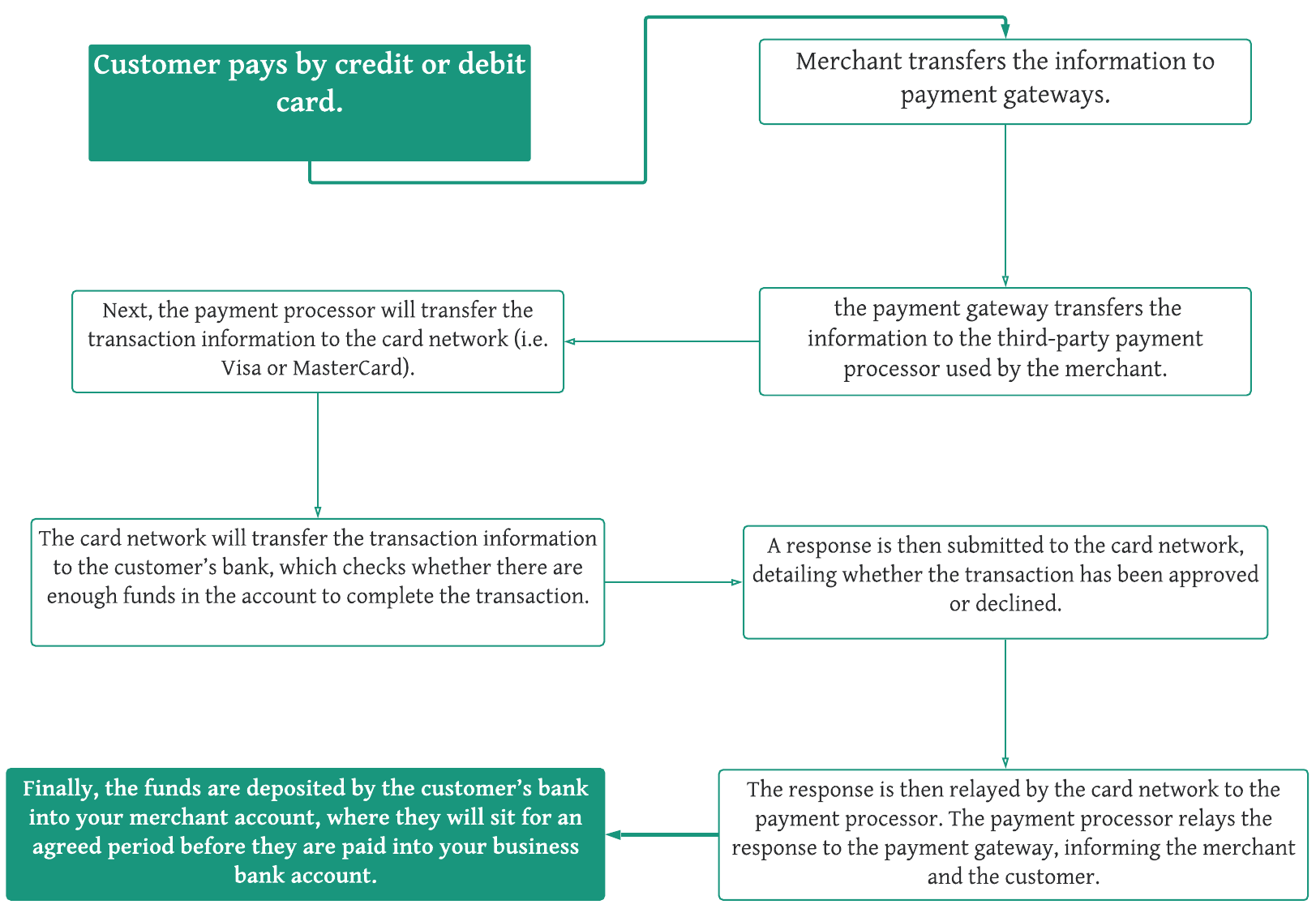

How does the online payment process work?

Conclusion:

To successfully manage the payments process, all these elements need to be included. The payment gateway handles the transfer process, the payment processor authenticates and secures the transaction, and the merchant account is where the bank settles the funds, before they’re paid into your business account.

We know that finding the right online payment partner is not an easy task. Talk to our expert team for the list of payment processors for your desired jurisdiction and for the plans that works best for your business.

There are thousands of solutions out there (there are 500 EMIs in Europe alone, 1400 Money Service Operators in HK) , don’t waste your time talking to everyone. Talk to the experts who can provide you with a unique, proven working solution!

If you are an FX broker from an entry level jurisdiction, and are struggling with finding the right payment solutions – please contact us. For a small fee our team of international FX Industry experts will guide you through the challenging process of setting up a bulletproof payment solution system for your FX brokerage: GET STARED NOW!